Focus Burlington is a group of volunteers dedicated to promoting a safe, secure, and sustainable future for all residents of Burlington. Group members recently attended all the city’s town hall meetings on the 2026 budget.

Accompanying the mayor at every meeting is our very own Deputy Mayor for Strategy and Budgets, our Ward 5 councillor.

Here are some of the statements made by the Ward 5 Councillor, along with the facts we found.

That ‘90s Show – Episode 1

For some reason, the councillor from Ward 5 always talks about the 90s. This is the third year that we’ve attended budget meetings, and the reason for huge tax increases is always something to do with the 90s. You’d think that at some point, the current council would just fix the issues instead of continuously raising taxes and blaming the 90s.

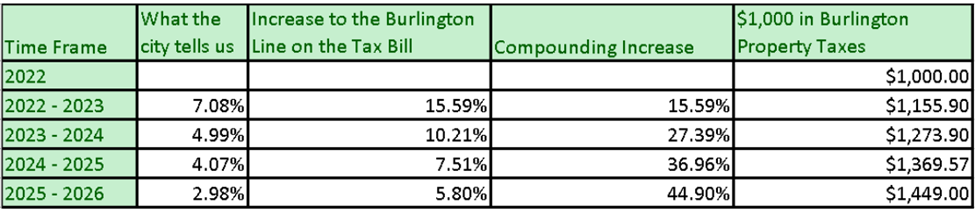

Significant tax increases started after the 2022 municipal election.

Here is a quote from an unofficial transcript of the Monday, September 28th meeting, our Ward 5 councillor says:

“You’ll notice this one page 12, that one, okay, so on the bottom right, left-hand side, you’ll see it says, historically underfunded city of Burlington budget, and it said there were 0% tax increases in the 1990s so from 1990 to 1997 where there was zero tax increases for, I think it was seven years. So had we simply added 1% a year …”

Fact Check

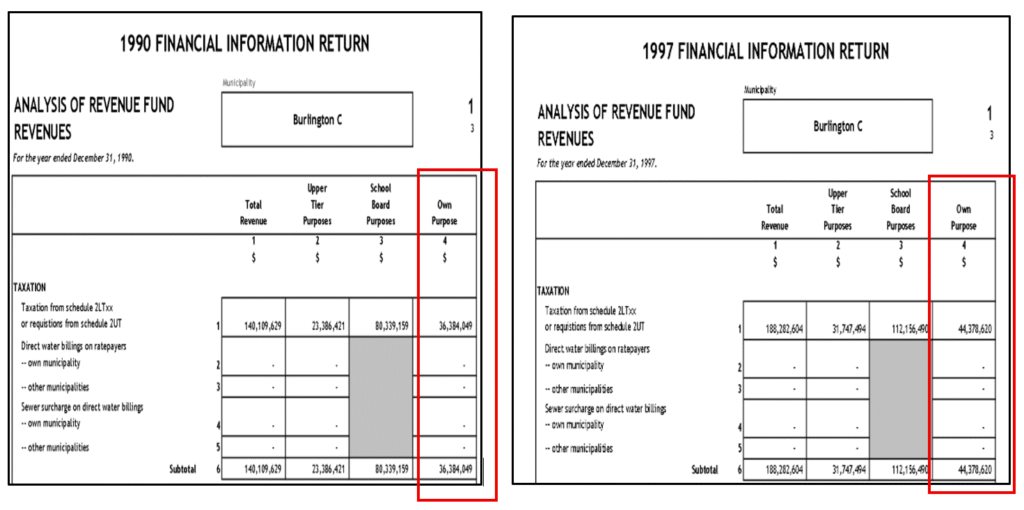

The Province of Ontario keeps Financial Information from Municipalities online. We were able to hop in a time machine and go back almost 35 years.

For the year ending December 31st, 1990, Burlington collected, for “Own Purposes” $36,384,049 in property taxes.

Fast-forward to December 31st, 1997, and Burlington collected, for “Own Purposes” $44,378,620 in property taxes.

That works out to a 22% increase in property tax revenue over the seven years the councillor claims had zero percent increases. The population of the city did increase between the census years of 1991 and 1996 by 5.7%. Inflation increased 15.7% from 1990 to 1997. All things being equal, property taxes increased proportionally with inflation and the growth in population, not at zero percent as stated in every budget meeting, year after year, by the councillor for Ward 5.

Aldershot Pool Renovated 1995.

Tansley Woods opened in 1996.

The Appleby Twin Pad Arena opened in 1999.

The province has Financial Information Records dating back to 1988. In next year’s meetings, will we be hearing about zero percent tax increases in the early ‘80s?

That ‘90s Show – Episode 2

Another reason, we’re told, for Burlington’s large tax increases is computer equipment and software from the 90s. Again, attendees of budget meetings have heard this for at least three years and at all of this year’s budget meetings up to and including Monday’s.

Here’s another 90s-related quote from an unofficial transcript of Monday’s meeting:

“What I’m going to tell you is that we had our information technology systems were largely installed in the 90s, right? So if you bought a computer in 1990 and you were trying to use it today, you wouldn’t get very far with it. So we had our accounting system. It was SAP, it was put in the 90s, and it was grossly out of date.”

This is all well and good and should lead to savings every year going forward, right? Maybe not, our elected representatives don’t tell the civil servants what the budget increase percentage should be; the unelected civil servants tell our representatives.

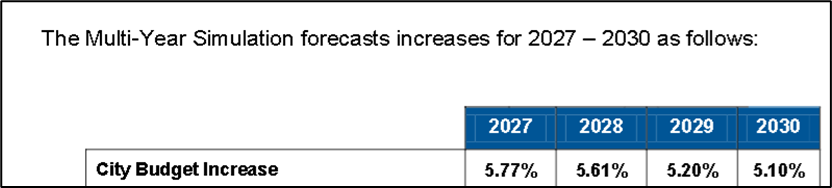

Here are the predicted budget increases out to 2030. No one understands the impact of US tariffs, no one understands what inflation will be, but we can bank on the city’s budget increases.

https://burlingtonpublishing.escribemeetings.com/filestream.ashx?DocumentId=89047 (Page 3)

Compounding those not-so-innocent 5-something percent increases shows that for every $5,000 in Burlington property taxes you’ll pay in 2027, you’ll pay $6,257 by 2030. Will salaries, CPP, ODSP, etc., be going up this quickly over the same time period?

Following Monday’s meeting, we emailed the Ward 5 councillor for a list of the remaining software applications from the 90s and learned that all the applications had been replaced. Not surprisingly, during the sixth of six meetings, after we asked our question, there was no mention of out-of-date software applications. We’re looking forward to fact-checking new reasons for the 2027 budget increase. We’re also wondering why, after at least a million in consulting fees to install new software applications, are our taxes still going up!

Where are the new assessment dollars in the budget?

The 2025 Burlington property tax increase was softened by new homes and businesses that started paying property taxes in 2025. New condo towers are under construction; once they become occupied, each unit starts paying Burlington property taxes.

In 2025, the city budget increased 8.3%, but the Burlington line on our tax bill went up 7.51%. The difference was covered by taxes from new homes and businesses.

The city is showing another .75% increase in new assessments in the 2026 budget blueprint. When asked why the budget increase of 5.8% was not resulting in a property tax increase to existing home owners of 5.05% we heard this from our Ward 5 councillor:

“The assessment growth is in the budget. It’s an area of revenue, so it absolutely is captured there. And, yeah, it does. It would be higher without the assessment.”

So last year new assessment growth reduced the tax increase, and this year not so much. Thanks for the transparency.

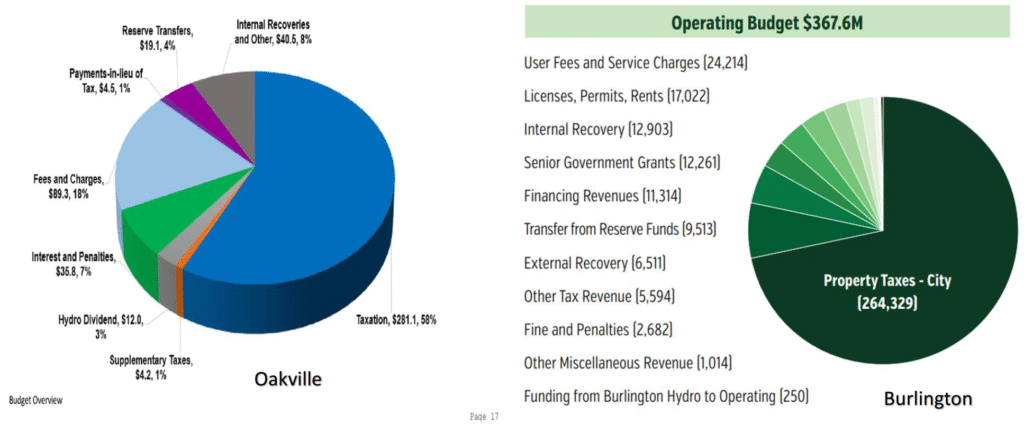

Oakville compared to Burlington

Here is a quote from an unofficial transcript of the Monday, September 28th meeting, our Ward 5 councillor says:

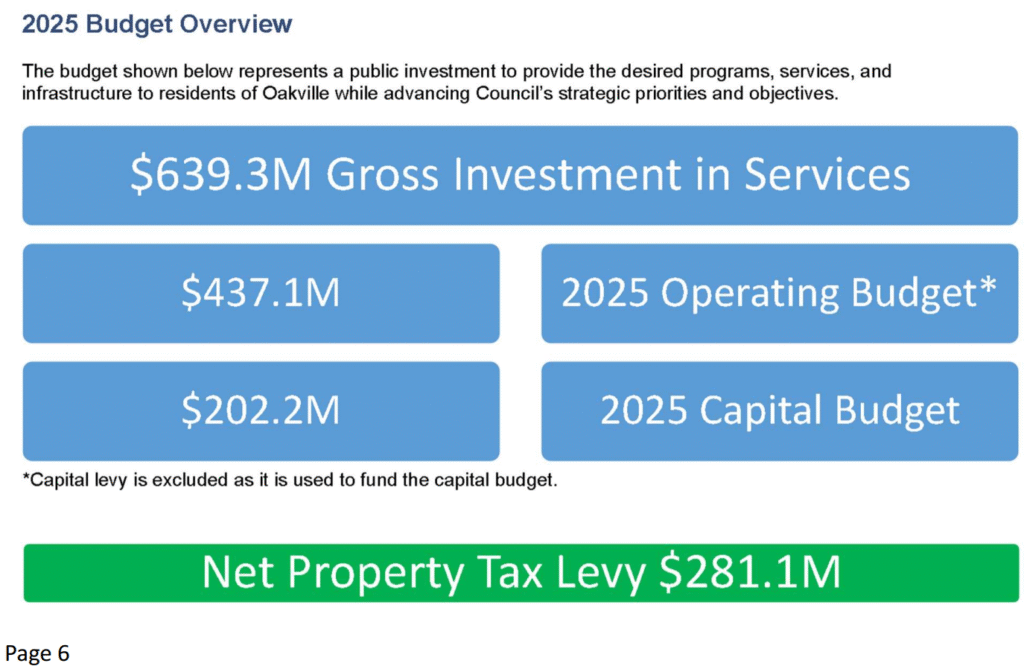

“Oakville’s capital budget is $100 million or more, and operating is $200 million. So sometimes folks say, Well, we’re the same size as Oakville. Why can’t we have this service or that service, and they’ve got the budget for it? So we’re trying. We’ve been trying to play catch-up a little bit because of that.”

Fact Check

Oakville has not released figures for 2026. For 2025, the Town of Oakville’s capital budget is $202.2 million, and the operating budget is $437.1 million.

What is interesting about Oakville is where the money comes from, with the $281.1 million in property taxes accounting for 58% of the total revenue.

In Burlington, and using numbers from the 2025 budget to compare apples to apples, Burlington’s $264.3 million in property taxes represents 72% of the income.

In 2025, Oakville collected 6% more in property taxes than Burlington, but had 10% more people living in the city.

Burlington’s user fees and service charges are 6.5% of revenue compared to Oakville’s 18% raising the difficult question: should everyone pay higher taxes to keep fees low, or should the people pay for the services they use?

We all make mistakes, and no one expects our politicians to know everything.

Year after year, we hear about zero percent tax increases in the 90s. Publicly available, factual information disputes this. Perhaps one of the city’s many communication channels can be used to issue a statement clarifying the record.

Year after year, we hear about software applications from the 90s. Something is seriously wrong if these applications have not been upgraded or replaced.

The budget blueprint doesn’t show where almost $2 million in expected revenue from new assessments is accounted for, stating that “it’s in the budget” is not an answer.

In a 90-minute meeting, a good 15 minutes is spent talking about the 90s, maybe it just felt like 15 minutes.

We often hear about alternate facts. It’s time to get back to basics. Facts are facts. Truth and accountability matter, especially when dealing with a $491.9 million operating and capital budget.

Tired of higher taxes? Complete our quick budget survey here: https://www.focusburlington.ca/2026-budget-survey/

Discover more from Focus Burlington

Subscribe to get the latest posts sent to your email.

Ward 5 representative needs to use the facts and not flim flan the numbers.