Focus Burlington, a group of volunteers, we took a look at the 2026 Budget Blueprint and here’s what we found.

From 2022 to 2026, the Burlington line on our tax bill will increase by 45%. Here’s the explanation.

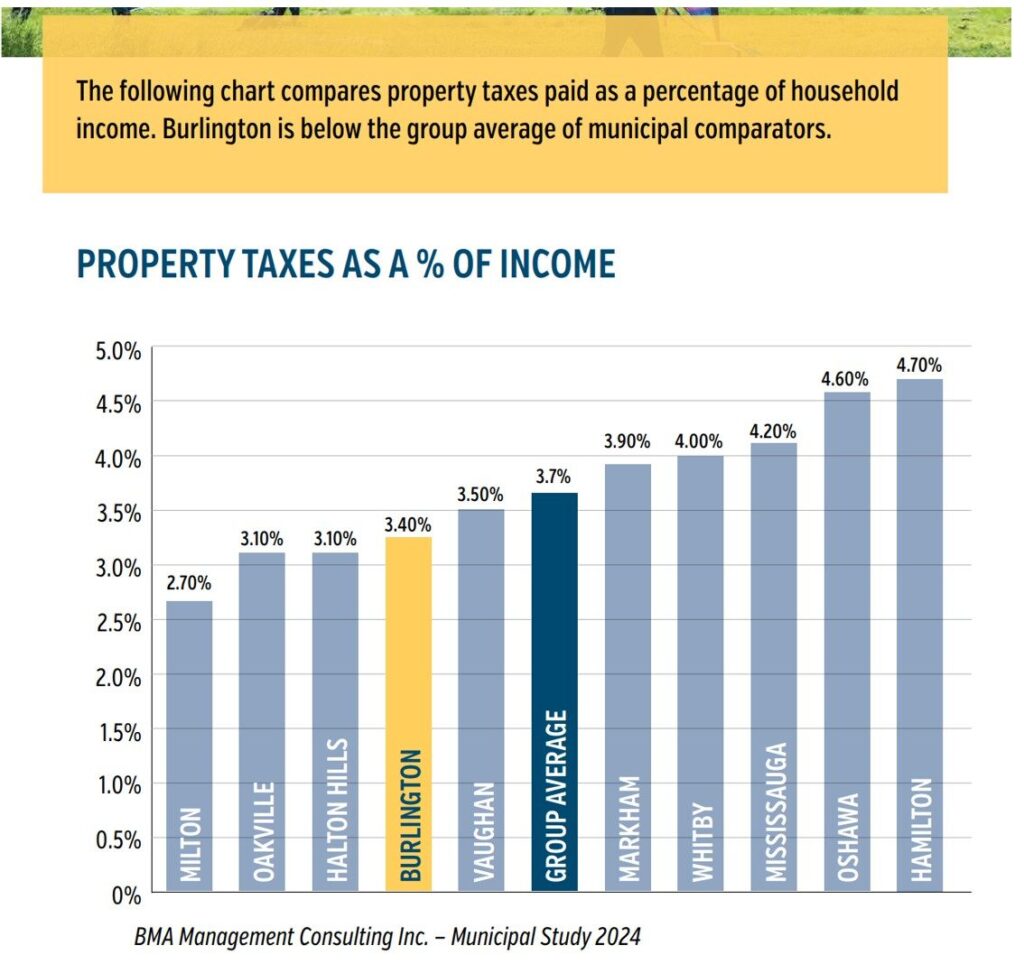

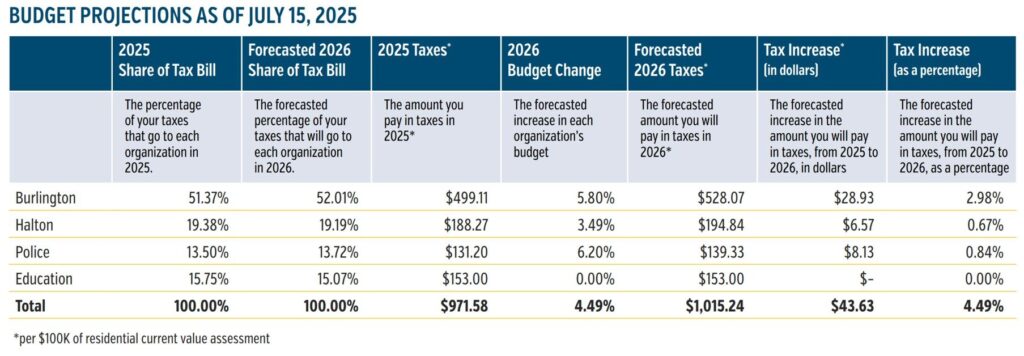

Our tax bill has three lines on it: one for the city, one for the region, and one for education. We’ve seen the city’s line march steadily higher since this council was elected in 2022. The change in the total bill is over 26% with Burlington’s large increases being softened by reasonable increases from the region and no increase to the education line.

The city expects to collect $264,329,000 in property taxes this year (2025). The 2026 increase of 5.8% will bring in an additional $15,331,082. If Burlington’s 2026 property tax increase were limited to inflation, the additional amount would be $10 million less.

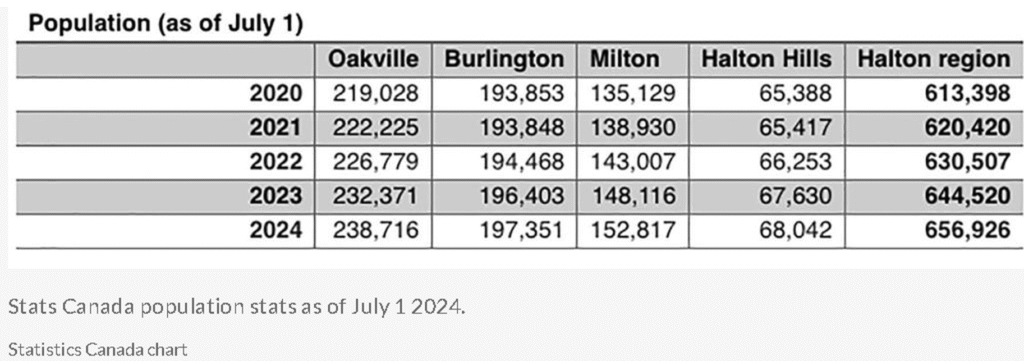

In Ontario, it is very difficult to compare the efficiency of municipal governments, but when the communities are in the same region, the comparison is easier. Halton Region is responsible for many services, including affordable housing, policing, and public health, services that have been under pressure from provincial downloading and federal immigration policies.

For 2026, Oakville is projecting total property tax revenue of $291,000,000 for 238,716 people or $1,218 per person

Burlington is projecting total property tax revenue of $282,206,000 for 197,351 people or $1,429 per person.

If Burlington were able to deliver services at the same per-person cost as Oakville, the annual savings would be over $41 million a year.

Where does the money go?

What about employees and consulting fees? The number of full-time employees is up 14% since 2022. Consulting fees are up almost 100%. What is the root cause of the increases? Are more people demanding more city services? Not likely, population growth is only about 3% over the same time period.

Does the 2026 Budget Blueprint make any sense?

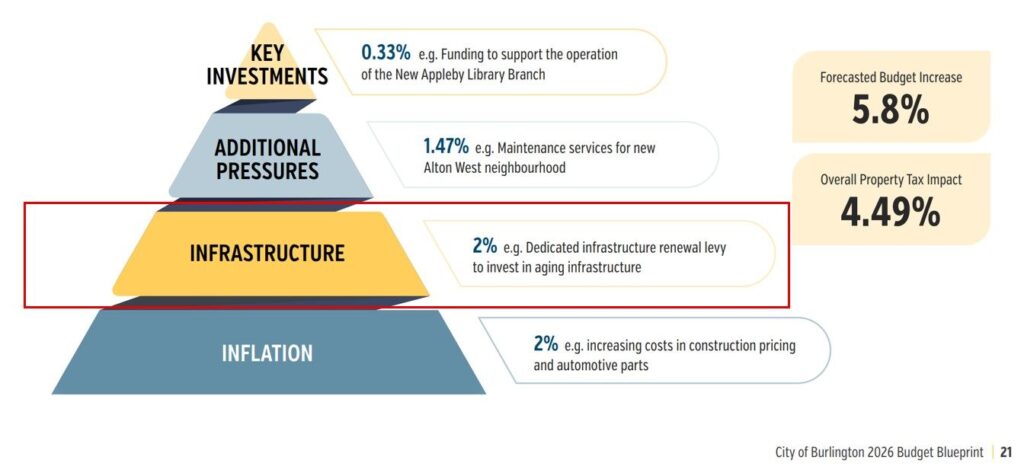

We have to start by saying the blueprint document was put together by people who tell us a 5.8% property tax increase is 2.98%. These are the same people we entrust with hundreds of millions of dollars every year. When the mayor was asked what the 2.98% number means, she answered that it was a way for us to compare the increases from the city, the region, and the police. The ward 5 councillor added that it was a weighted average. The heading in the chart is “Tax Increase (as a percentage)”. Presenting the data this way masks the impact of the Burlington property tax increases. Trust and respect are something elected officials need to earn and keep, not demand through initiatives like Elect Respect.

Millions for Alton West!

Page 21 tells us that 1.47% of the tax increase is required for “Maintenance services for new Alton West Neighbourhood”. Alton West is a neighbourhood of roughly 300 homes; this across-the-city tax increase totals over $3.8 million, which works out to over $12,000 per home in Alton West. We are still waiting for a detailed explanation from the Ward 6 councillor.

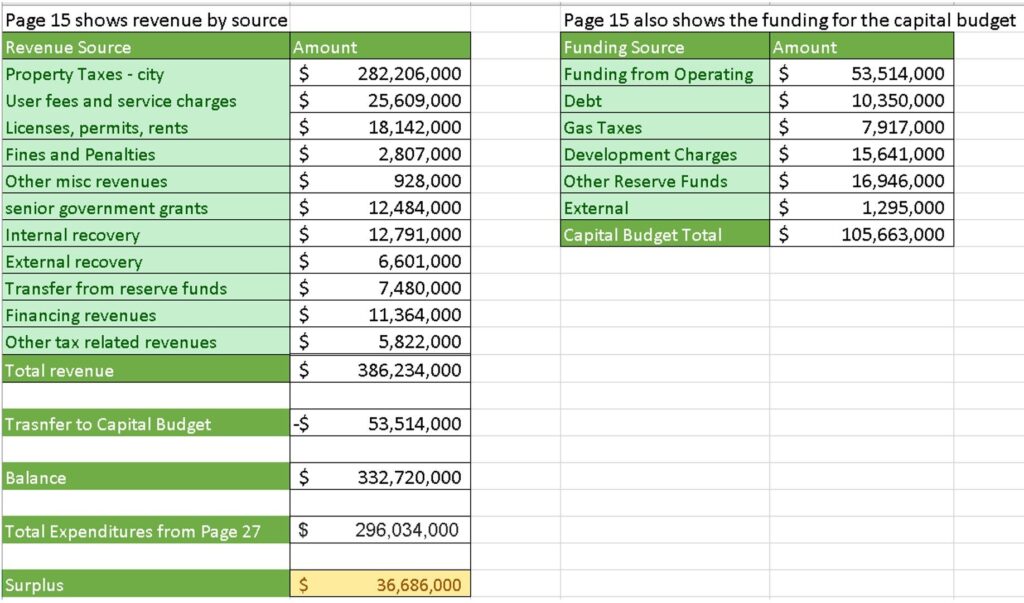

Millions of surplus money!

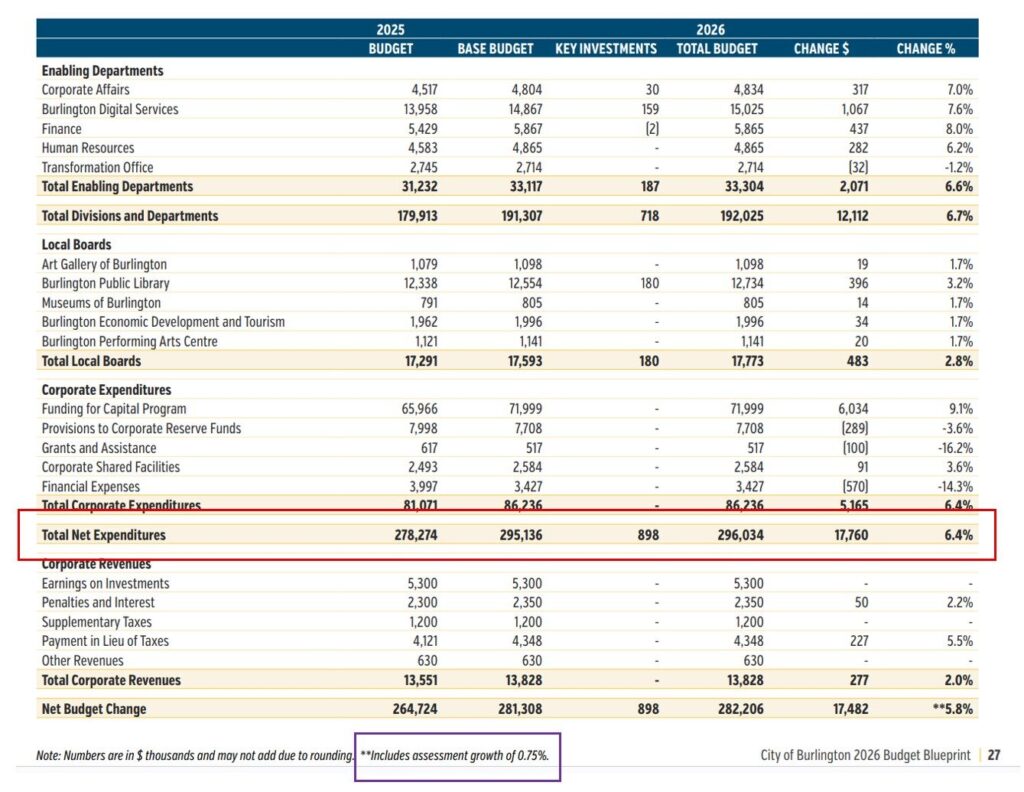

Page 15 shows us total revenues of $386,234,000, with the lion’s share coming from property taxes. We put the numbers into Excel, subtracted the total expenses shown on page 27 and ended up with a $36 million surplus.

The budget blueprint doesn’t show a surplus or explain how it will be used.

The revenue numbers for the capital budget show an additional $10,350,000 in debt being taken on by the city despite the details showing a large surplus.

Does the budget even matter?

Pages 26 and 27 of the budget blueprint show us the “Base Budget”, the amount of money the city expects to spend this year (2025). The base budget is the base for the 2026 budget. The same pages show us the budgeted amount for 2025. We can see that Total Net Expenditures in 2025 exceeded the budgeted amount by 6.06%.

If you did this at home, you’d have to borrow money to cover the difference or declare bankruptcy. Luckily, at least for the city, when the city spends more than the budgeted amount the solution is to raise taxes.

Where is the assessment growth?

In 2025, the budget increased by 8.3% but new homes contributed new property taxes. Those new property taxes reduced the increase to the Burlington line on our tax bill to 7.51%. Page 27, shown above, states “**includes assessment growth of 0.75%” but we can’t find any other references to assessment growth or where this new revenue is in the budget. Assuming .75% is correct, this works out to almost $2 million.

2% for infrastructure in 2025, 2% for infrastructure in 2026, …

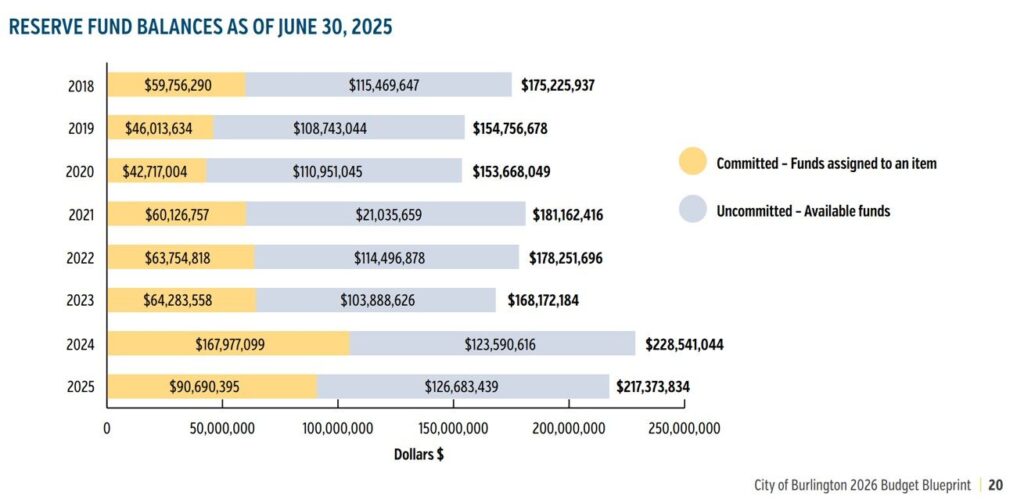

Infrastructure spending is a long-term game. You move into a new house in a new subdivision. The developer paid for the road in front of your house and included the cost in the price you paid for the home. You start paying property taxes, and fifty years later, the road needs to be replaced. Every year, a small amount of your property taxes should be set aside and placed in a reserve fund. When the road needs replacing, the city takes money from the reserve fund and replaces the road. Reserve funds fluctuate from one year to the next.

Reserve funds can also be used to manage expenses for unforeseen events, such as flooding.

Page 20 of the budget blueprint shows us how Burlington’s reserve funds are holding up.

Despite a 2% tax increase in 2025 for “infrastructure”, amounting to an additional $4,880,859 in revenue every year going forward, our reserve funds are down 5% or over $11 million.

Page 21 shows us another 2% increase for a “dedicated infrastructure renewal levy” is coming our way in 2026, resulting in an additional $5,286,576 in revenue every year going forward. Obviously, the money is not going to reserve funds. Where is the money going?

Burlington’s budget blueprint is a beautiful document, full of pictures and graphics. Page 5 states the budget principles as Affordability, Livability, Sustainability, and Transparency. Sadly, the financial picture is anything but transparent, as important details are missing or hard to find.

Showing a 5.8% tax increase in a column labelled “Tax Increase (as a percentage)” as 2.98% combined with diminishing reserve funds, increased debt, and increased taxation, all point to a difficult future for Burlington. We’ll have a chance to provide input on the budget process during the next municipal election on October 26th, 2026. Until then, please complete our budget survey